Get the app

Get Dash

Dash is easy to buy or receive online, from friends, or at an ATM near you.

Get Going!

Grab a coffee, buy a plane ticket, or pay your phone bill. Dash is growing and is accepted by new businesses every day.

Pay Friends and Family

Airfare, Utility Bills and Subscriptions

Groceries and Dining Out

Buy Electronics and IT Equipment

Find Hotels and Lodgings

Business Services

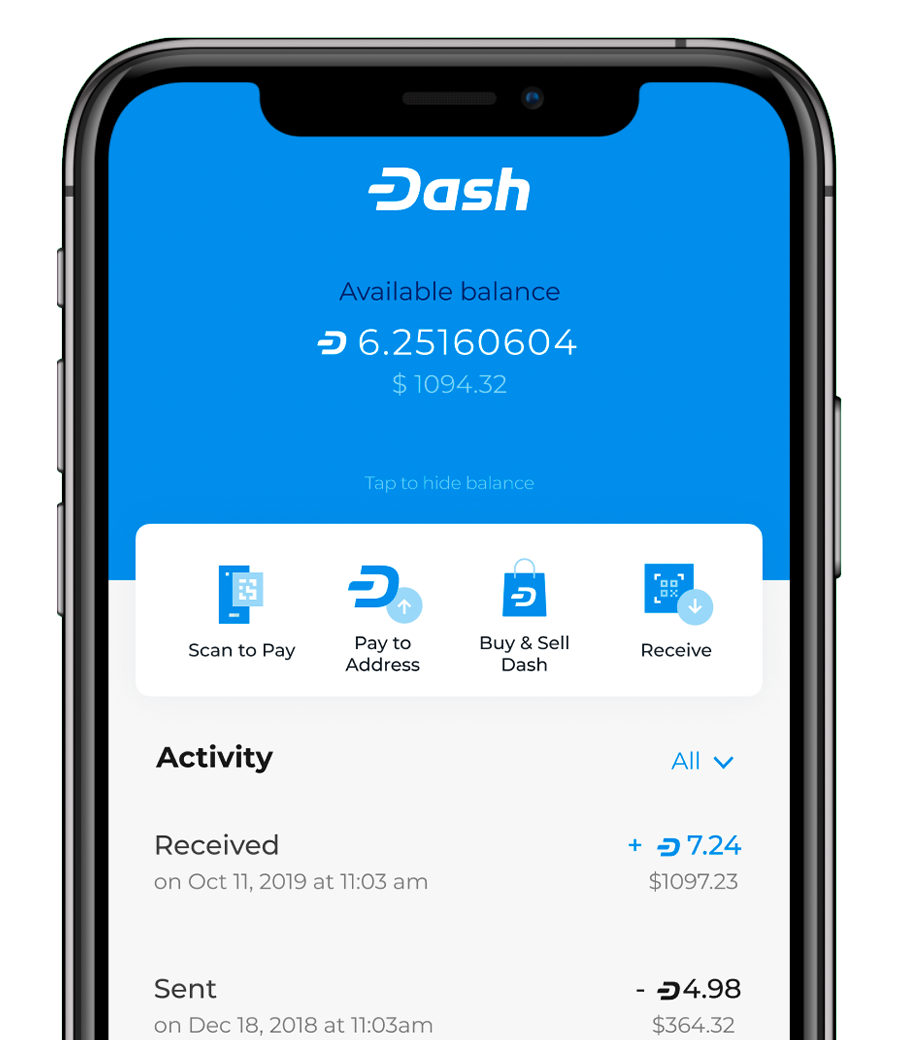

DashPay Wallet

Coming Soon

Experience cryptocurrency payments in an enhanced easy-to-use user experience and with social factors like username, contacts and personalization

Merchants & Services

159000

+

Exchanges and Brokers

265

+

Transaction Speed

1

Second

Real world vendors accept Dash currency

Dash is accepted globally by businesses of all shapes and sizes. Our low fees and instant transaction time make Dash the preferred method of payment around the world.

Payment Volume $

4.48

Billion+

Daily Active Addresses

54300

+

Transactions/Day

8220

+