What happens with marketcap in your specific redenomination ? Due to the free claiming of Dash i suspect the Dash supply will expand ?

So expanding supply x lower price = same marketcap as now ? Correct ?

Yes, all things being equal the MC would remain the same, but we know that would not happen, because people favour the cheaper coins, so we would see increased demand for DASH at the lower prices, so I reckon, the MC would probably actually increase by 20% just on the redominination.

And how does this it affect our max coins ever to be generated ? (currently estimated at 18,9 million Dash, according coinmarketcap)

Sounds to me like your proposed redenomination hard fork will change Dash coin emission schedule directly, as it changes the (circulating) supply and possibly also the max number of coins to be generated.

Yep, the max supply would increase, however, the rate of emission should stay the same, I would not support a change that also lowers our inflation, which means coinbase rewards should be 100x what they are now and the DAO would get 100x the monthly coins too. So, our final supply should be roughly 100x the current max supply, but in reality it will be less due to a significant amount of DASH that is forever lost and hence not all DASH will be free claimed.

I would not touch the collateral requirement of masternodes by the way, i disagree that 1000 Dash (or the equivalent of that number after redenomination) is too much and i would be surprised to see consensus formed on reducing the collateral for masternodes with 50%. Even Dash Core Group does not want to lower the collateral for masternodes.

I see a lot of talk about MNs being too expensive and the need for shared MNs (ugly solution). I do not support shared MNs, for one thing, there is no good way to implement it without a lot of ugly hacks that make the network far more complex than it needs to be. Shared MNs means you wish to invest into one with someone else eg, family or friends. Number one rule, never invest in something with family or friends, this is how you ruin relationships, do yourself a favour and keep money out of relationships, you will have a happier life. We already have trusted shared MNs eg crowdnode.io so the shared MN issue is actually sovled already and best thing is you share it with strangers, so no stress on your personal life ! Reducing the collateral requirement to 50% of what it is now even down to 20%, just makes the MNs more accessible to more people and this has the advantages of fixing everything I just mentioned along with increasing the decentralisation of the network. You will note that critics of the masternode system claim that Masternodes centralise the coin, if we make them cheaper (more accessible) we solve that too.

Also too many masternodes on our network could make our network underperform (it could slow the network, make it less efficient with regards to quorum usage, block propagation, etc).

This concern I have heard often and it mostly comes from DCG and I am here to tell you today that it is FUD, pure and simple this is a FUD. The Bitcoin network runs about 18k full nodes and TXes propogate through that network in a second or two. It is super fast. If the DASH network had 20K nodes I have no doubt it would do just fine propogating those TXes, infact it has more nodes than there are MNs, did you know?

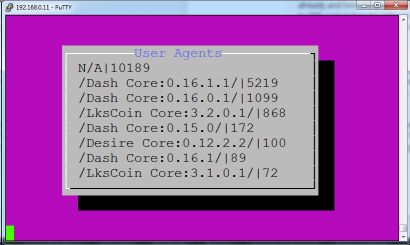

Above is a network crawler I wrote that goes to each single node on the network and checks the version of the running node and extracts a known list of nodes to it and goes on crawling. What you see there is the top row, the N/As are the number of nodes that cannot be connected too, eg full nodes behind a firewall, there are 10k of those. Then we have 5200 v16.1 full nodes and 1100 v16.0 full nodes, most of which are Mnodes, but note that currently there are only 4749 mnodes, so the difference is full nodes run by exchanges and explorers, chainanalysis 3-letter agencies. Then you have some nodes from forks done of DASH by idiots that didn't know how to properly fork DASH 'LksCoin' and the rest is junk since it is forked off the network.

The point is, the DASH network is already larger than we think it is and working just fine and dandy.

I feel that redenomination and the collateral of masternodes are two seperate topics, that should not be merged that easily into one DIP.

I am fine with this, I just saw this a good oppurtunity to lay to bed the shared MNs nonsense and the Mnode is too expensive tripe, but ultimately the nature of this DIP would have to get more community feedback to see if the collateral requirements for Mnodes should be adjusted down or not. In reality, it can be done at any time, so no big deal.