This idea has been suggested. There are several pros and cons. Because miners are ultimately making a bet on Dash, they have significant interest in seeing Dash succeed, not just masternode operators. The approach we've suggested in which the cost of proposals reduces both masternode and miner rewards proportionately helps ensure that beneficial proposals are more likely to receive approval. If you required the full cost of the proposal to come exclusively from the masternode portion of the reward, yet MNOs only receive a portion of the expected benefit (which accrues to miners, users, and masternodes), that creates misaligned incentives. It does introduce an additional source of variation for miners, but this is minor compared to the price uncertainty over the life of the miner's equipment. At the same time, it reduces the variation for the masternodes and protects against the risk of passive MNO investors selling in large numbers due to a sustained period of heavier proposal spending. Given that 60% of the proposal cost would come from masternodes under the proposed plan, that should be plenty of incentive to scrutinize proposals. As designed, MNOs are expected to provide 60% of the cost, yet receive less than 50% of any benefit (since less than 50% of coins are MN collateral)... that should align their interests with the networks better than requiring them to fund 100% of the cost.What about the idea of keeping miner rewards fixed and letting the unspent treasury accrue to masternodes only. Your plan of letting miners share in the unspent treasury adds unnecessary uncertainty for them and dilutes the basic idea that masternode owners can directly benefit from being responsible with treasury funds.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dash Economics Discussion Series

- Thread starter HeyMichael

- Start date

Money that moves from MNOs to proposal owners can open up MNOs to legal attack i.e. the funding of illegal activity. This is one big reason I could not possibly support this proposal. The Dash Iran proposals is one such example; many American MNOs were nervous to provide support to a country under US sanctions. If it's hard to convince them based on a vote, it's going to be even harder when MNOs are effectively financially contributing. For even if someone votes No, they could still be financially supporting it if all other MNOs vote Yes.

Dash is a global cryptocurrency and DAO that should be open to all without bias or prejudice.

Dash is a global cryptocurrency and DAO that should be open to all without bias or prejudice.

Is it possible to change the block reward? Yes, of course. Would it permanently solve for the circulating supply growth rate by simply changing the supply? No.Can we just vote to change block reward like we vote proposals? Small adjustment each cycle: up, down or no change. Like MKR do. We can vote change of fees too. I mean all automatic.

This may seem counter-intuitive, so let me explain further. Increasing the block reward would cause ROI of masternodes to increase, so masternodes would be incentivized to continue increasing the reward into a runaway cycle that would likely lead to hyper inflation. It would stave off the issue in the short-run, but would ultimately "kick the can down the road" or potentially lead to an even larger challenge in the future. Decreasing the block reward would cause ROI of operating masternodes to drop, which would result in a significant number of masternodes exiting the market (e.g., deciding to sell their collateral). The liquidation of masternode collateral would also lead to a rapid increase in the circulating supply.

So fiddling with the block reward is not a viable solution to limiting the growth rate of the circulating supply. In particular, increasing the supply may be very difficult to do while maintaining confidence in the scarcity of Dash.

We will assess it on an ongoing basis and will publish a range of expected growth that we can measure against (this will be included in the proposal). If it deviates from the expected range for an extended period of time, or by an extreme amount, we can develop an appropriate course of action.It seems incredible that such a small change can have an impact. I see you are basically trying to flatten the curve of available money supply and I understand that. You have my support. I would like to know how long you think this needs to be in place before evaluating whether or not it worked? Seeing how the supply apparently smoothes out over time, I guess we either get it right on the first try, or evaluate monthly (very often) to see if more adjustments are needed? Or are we throwing an educated guess hail Mary and be done with it?

Not that that's bad, but if it falls apart, how long would it take to reverse the changes? Is there a safety net in place? I don't foresee any troubles, but if it whacks out our balance ...??? What if assumptions are incorrect? Anyways, I'm all for this

Perhaps someone can explain why the masternode count has been going up without intervention?

Yes - Binance has started a number of masternodes as backing for the their savings facility here: https://www.binance.com/en/lending

Hopefully the proposal will be ditched when they realize that value-add should be given to end users, not MNOs.

This forced proposal "debate" is exactly why voting should be stripped from MNOs, because the goals of MNOs are completely out of whack with it's U-S-E-R-S.

MNOs are paid to keep the network up, that's it, it works well, nothing more, nothing less. 1000 dash is no more special than, say, 500 dash. Holding 1000 dash doesn't suddenly make MNOs more intelligent.

Please, drop the direction of this proposal, stop moving numbers around on a spreadsheet, and start addressing the wishes of our end users.

Or carry on and watch Dash drop further in rank. Don't ask yourself why and continue to blame "inflation". This is not a dash-dollar debate, it's about DCG failing to stay relevant. As Amanda would say, this is currency competition.

This forced proposal "debate" is exactly why voting should be stripped from MNOs, because the goals of MNOs are completely out of whack with it's U-S-E-R-S.

MNOs are paid to keep the network up, that's it, it works well, nothing more, nothing less. 1000 dash is no more special than, say, 500 dash. Holding 1000 dash doesn't suddenly make MNOs more intelligent.

Please, drop the direction of this proposal, stop moving numbers around on a spreadsheet, and start addressing the wishes of our end users.

Or carry on and watch Dash drop further in rank. Don't ask yourself why and continue to blame "inflation". This is not a dash-dollar debate, it's about DCG failing to stay relevant. As Amanda would say, this is currency competition.

qwizzie

Well-known member

Hopefully the proposal will be ditched when they realize that value-add should be given to end users, not MNOs.

The value-add for endusers is lower inflation.

The value-add for endusers is lower inflation.

What was wrong with inflation when dash was $1500?

It's very simple to understand this; DCG has been consuming 60% of the treasury and yet under-performing in their job. And the evidence is not just price support but more importantly rank and comparison to similar projects. Dash is now rank 23 and possibly heading lower, and here DCG wants a quick fix by shuffling a few numbers around.

The assertion of this proposal is that a more attractive ROI to MNOs, to lock up more dash and thus squeezing supply. Well, without any change in supply the masternode count has been going up. Shall we invent excuses for why that might be?

It is folly to chase ROI, it will attract scum that will ditch dash as quick as they arrive. There are plenty of other projects providing better ROI. Someone show me why dash in particular is better positioned for ROI than any other project.

With the likes of Kyber and Maker around, no one cares for ROI on a coin that has done zero to interface with ethereum. If dash is meant to be a universal payment solution, it needs to be interfaced into every single other project out there, whether that's ethereum or atomic swaps. ZCash is making inroads with ethereum, why not dash? Beam has atomic swaps with bitcoin and litecoin, why not dash?

Dash can't be a universal payment if their only plan is to get onto centralized exchanges, requiring KYC and excluding half the world's population that have little or no identification. But yeah, we'll just double the treasury and let DCG consume 60% of 20%.

qwizzie

Well-known member

What was wrong with inflation when dash was $1500?

It was particularly high due to the emission rate in Dash early years. The newly generated supply caused a high inflation on circulating supply.

Users were hit hardest as their Dash simply diluted over time, due to all that newly generated supply.

Masternode Operators / Miners were hit less with inflation, due to them receiving a part of the blockrewards.

Circulating supply inflation has been going down for Dash over the years (i think Ryan mentioned it fell from over 20% when Dash was $1500 to 7% with Dash current price),

but is nowhere near the level of any of our competitors (pretty much all below 3%) and is still hit hardest on the Dash users.

You can check the inflation of Dash and of some of our competitors here : https://terminal.bytetree.com/dash

More then anything this is a fight of Dash to control the circulating supply (flatten the curve) and its inflation over the next five years.

It is either that or waiting 10 years before our emission rate and inflation drops naturally to a competitive level and we will start to see benefits from that (less volatility).

Last edited:

Micheal John

New member

I wonder on the off chance that we could disperse the un-apportioned assets from the treasury every month to those ace hubs that casted a ballot in the past superblock, so as to expand casting a ballot investment.

We could even set aside those un-designated assets and re-appropriate them like clockwork to ace hubs with casting a ballot history.

We could even set aside those un-designated assets and re-appropriate them like clockwork to ace hubs with casting a ballot history.

Luiz_Ant0n10

Active member

What was wrong with inflation when dash was $1500?

It's very simple to understand this; DCG has been consuming 60% of the treasury and yet under-performing in their job. And the evidence is not just price support but more importantly rank and comparison to similar projects. Dash is now rank 23 and possibly heading lower, and here DCG wants a quick fix by shuffling a few numbers around.

The assertion of this proposal is that a more attractive ROI to MNOs, to lock up more dash and thus squeezing supply. Well, without any change in supply the masternode count has been going up. Shall we invent excuses for why that might be?

It is folly to chase ROI, it will attract scum that will ditch dash as quick as they arrive. There are plenty of other projects providing better ROI. Someone show me why dash in particular is better positioned for ROI than any other project.

With the likes of Kyber and Maker around, no one cares for ROI on a coin that has done zero to interface with ethereum. If dash is meant to be a universal payment solution, it needs to be interfaced into every single other project out there, whether that's ethereum or atomic swaps. ZCash is making inroads with ethereum, why not dash? Beam has atomic swaps with bitcoin and litecoin, why not dash?

Dash can't be a universal payment if their only plan is to get onto centralized exchanges, requiring KYC and excluding half the world's population that have little or no identification. But yeah, we'll just double the treasury and let DCG consume 60% of 20%.

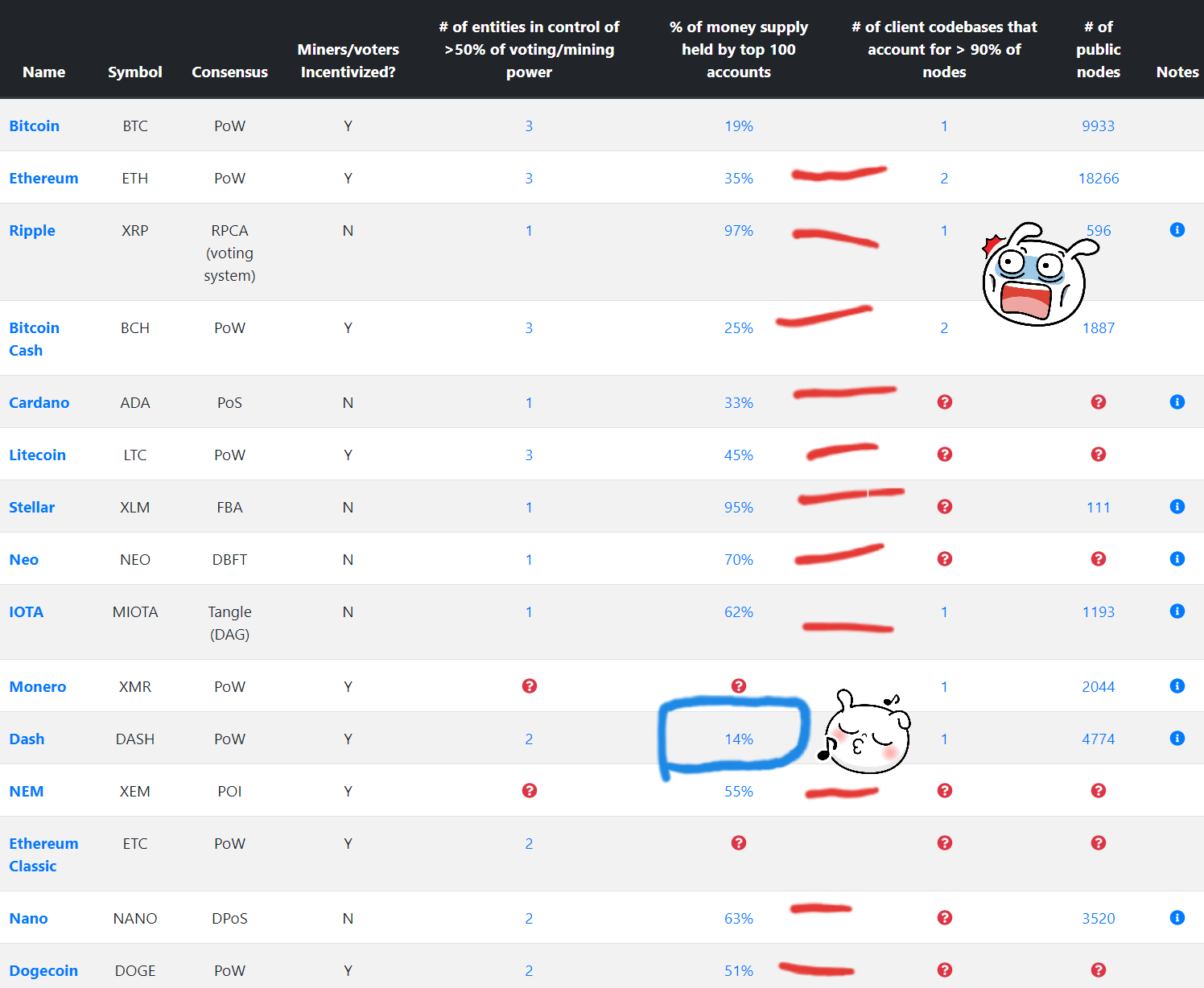

Hey friend! Why do you say "inflation" on Dash network? DASH has the best parameters of the crypto business.

Pay attention to the coin supply; the Dash Circulating Supply is 9.588.640 DASH; the Dash Max Supply is 18.900.000 DASH.

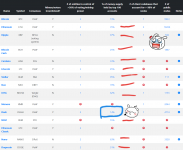

and the "% of coin supply held by top 100 accounts" as example:

There are more relevant questions to ask. What type of investor prefers "Chainlink" over Dash Chainlocks?

Who mined the Bitcoin first block? And who the hell has access to feb 2009 bitcoin holding? Is he satosi or his team?

the "premine" charges against Dash were absurdly unfounded; in my opinion, btc mined in feb 2009 is like "premined coins", is worse than the "premine" accusation.

Attachments

Hey friend! Why do you say "inflation" on Dash network? DASH has the best parameters of the crypto business.

Pay attention to the coin supply; the Dash Circulating Supply is 9.588.640 DASH; the Dash Max Supply is 18.900.000 DASH.

and the "% of coin supply held by top 100 accounts" as example:

There are more relevant questions to ask. What type of investor prefers "Chainlink" over Dash Chainlocks?

Who mined the Bitcoin first block? And who the hell has access to feb 2009 bitcoin holding? Is he satosi or his team?

the "premine" charges against Dash were absurdly unfounded; in my opinion, btc mined in feb 2009 is like "premined coins", is worse than the "premine" accusation.

Yes. It was Ryan that started this "conversation" about inflation. I think it's all just an exercise on how to direct MNOs to a single outcome.

The truth is, if DCG had been doing their job properly, we wouldn't be in this situation. Every quarter they do a presentation and tell us how real world usage is improving but I beg to differ. MNOs were disheartened when dash got to knocked to rank 15, and then to 20, and now 25. The facts are speaking for themselves yet MNOs insist on voting for DCG simply because the proposal system has no mechanism for competition. We can decrease coin emissions by 6% every month by simply voting No for DCG (60% of 10% treasury). Yet here we are being asked to double DCG's budget by moving to 60% of 20% treasury. We should not reward failure.

I don't mean to sound harsh when I say this but I think we need a complete re-org of DCG at the most senior levels. We need people that will place more priority on integrations with non-custodial entities e.g. DEXs and smart contract / liquidity platforms. We can start that process by making Bob Carroll the CEO of DCG.

Luiz_Ant0n10

Active member

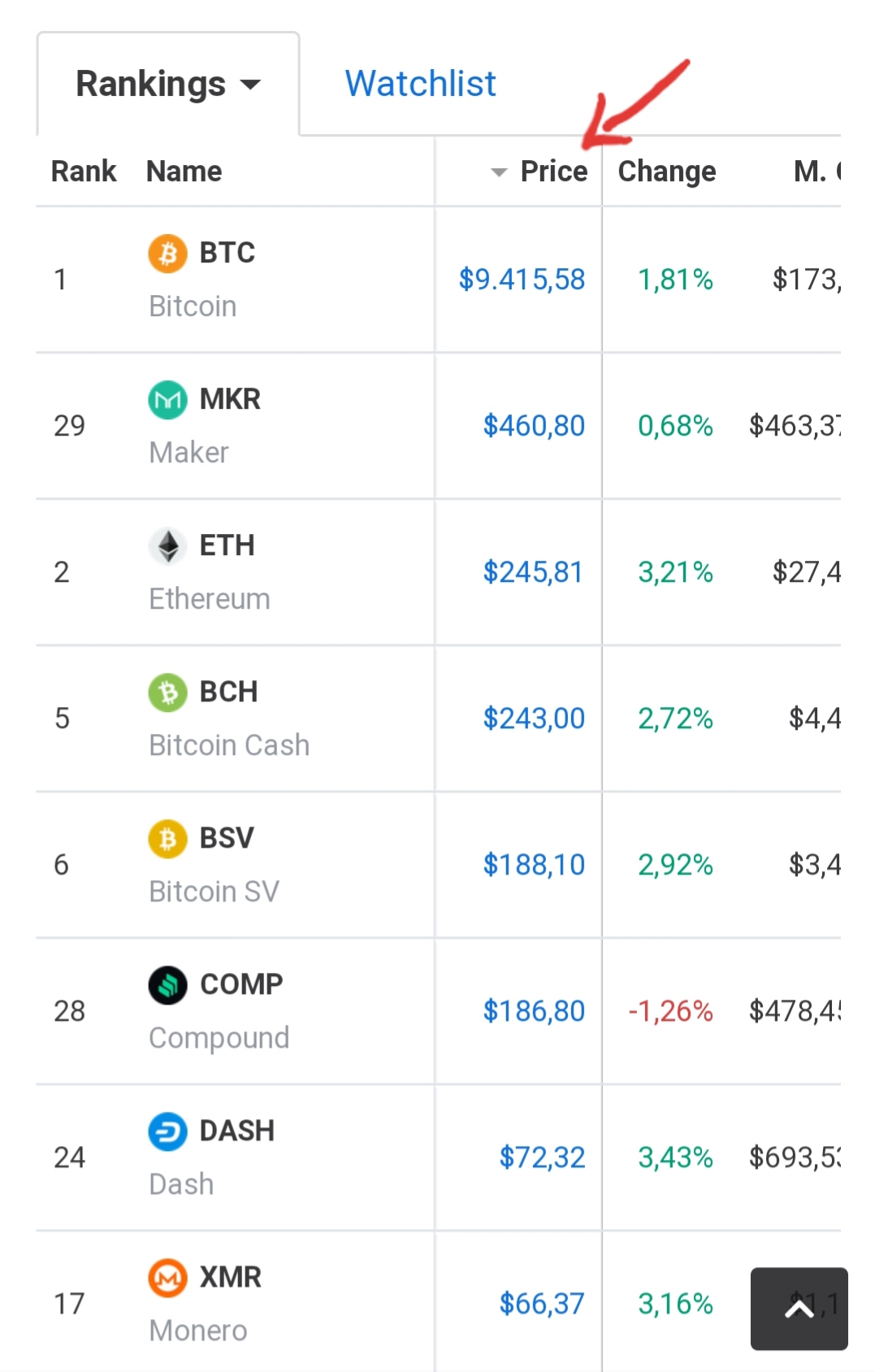

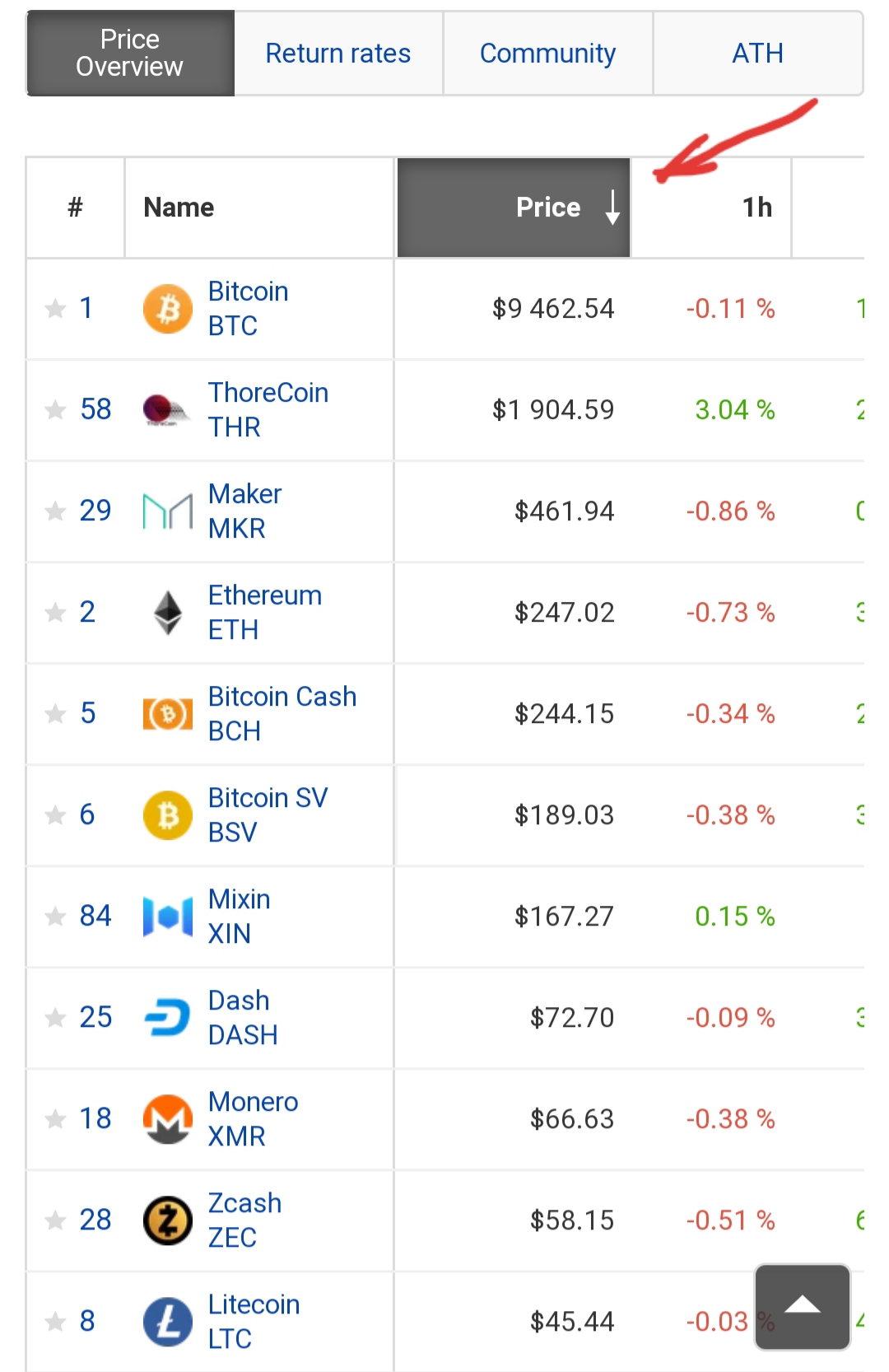

if you are moved by Coinmarketcap, please click on "Price" and be sure to also see the "Coin Supply":

Also here in Coinpaprika:

What type of investor prefers "Chainlink", LTC, XMR, XIN... MKR, THR... "Stellar" over Dash network?

Also here in Coinpaprika:

What type of investor prefers "Chainlink", LTC, XMR, XIN... MKR, THR... "Stellar" over Dash network?

Attachments

What type of investor prefers "Chainlink", LTC, XMR, XIN... MKR, THR... "Stellar" over Dash network?

Litecoin is about to get better, faster and easier privacy than dash.

XMR because when people called it a privacy coin, the community didn't spend years trying to convince people otherwise.

MakerDAO because it's the largest DAO with a more inclusive community than dash. $70,000 not required to participate.

Stellar, fast interoperability.

Decred, a DAO working towards full decentralization. Affordable participation (compared to dash). Decred DEX imminent, in open testing.

ZCash, actively contributes to privacy orientated organizations. Miners can mine directly to shielded addresses. The Halo protocol and their trustless proof-of-proofs could make privacy both fast and scalable.

Beam, quite possibly the best privacy coin. Privacy by default, atomic swaps (BTC and LTC). Nice mobile wallet. Quite fast and working on GhostDAG to vastly improve speed and scalability. Downside: centralized funding and development, not a DAO.

No one ever looked at coin market tables and decided to buy just one coin, and then go on to choose dash as their only one.

Luiz_Ant0n10

Active member

Litecoin is about to get better, faster and easier privacy than dash.

XMR because when people called it a privacy coin, the community didn't spend years trying to convince people otherwise.

MakerDAO because it's the largest DAO with a more inclusive community than dash. $70,000 not required to participate.

Stellar, fast interoperability.

Decred, a DAO working towards full decentralization. Affordable participation (compared to dash). Decred DEX imminent, in open testing.

ZCash, actively contributes to privacy orientated organizations. Miners can mine directly to shielded addresses. The Halo protocol and their trustless proof-of-proofs could make privacy both fast and scalable.

Beam, quite possibly the best privacy coin. Privacy by default, atomic swaps (BTC and LTC). Nice mobile wallet. Quite fast and working on GhostDAG to vastly improve speed and scalability. Downside: centralized funding and development, not a DAO.

No one ever looked at coin market tables and decided to buy just one coin, and then go on to choose dash as their only one.

Do you remember the "crypto called DAO" in 2016? After all DASH proved to be the best DAO.

The Dash's DAO is the great idea on the crypto business.

https://dashnews.org/dash-first-dao/

Last edited:

Do you remember the "crypto called DAO" in 2016? After all DASH proved to be the best DAO.

The Dash's DAO is the great idea on the crypto business.

https://dashnews.org/dash-first-dao/

♂

Yes, dash is the best in so many ways.

Some projects have merit and it doesn't really help that much to put other projects down to make dash look better.. unless, of course, it's true, in which case I fully support an all out attack. The Lightning Network is a good example of a failed project which still somehow gets touted as the great solution to scaling.

Request for DCG When v16 comes out with the updated reward allocation, please also provide binaries with the new updates / backports but using the current reward allocation.

Request to others In the event DCG does not provide binaries using the current reward allocation, can someone here please provide binaries or give instructions for doing it myself.

Thanks

Request to others In the event DCG does not provide binaries using the current reward allocation, can someone here please provide binaries or give instructions for doing it myself.

Thanks

... I'm hoping we see proposals broken out as follows:

1. Change the allocation 9% towards masternodes?

2. Allocate leftover treasury funds to masternodes and miners?

3. Increase treasury cap to 20%?

I think this would provide enough granularity in case something doesn't pass, and allows simple followups in the next cycle.

Bump.

If issues 2 and 3 are submitted as separate proposals, if one doesnt pass, followups will be easier than if they were combined.