Checkerama

Active member

EDIT: Thanks for all of the responses. In order to really consolidate all that I have been trying to perceive on this post, I have created an article on medium with mathematical models and indicators to show the competition SHA-256 mining brings to x11 mining, and how this will incredibly inhibit the possibility of DASH global infrastructure worldwide. Check it out:

https://medium.com/@aquilesgomez/hi...11-algorithm-on-the-dash-network-f48533a5e6fe

https://medium.com/@aquilesgomez/hi...11-algorithm-on-the-dash-network-f48533a5e6fe

https://medium.com/@aquilesgomez/hi...11-algorithm-on-the-dash-network-f48533a5e6fe

https://medium.com/@aquilesgomez/hi...11-algorithm-on-the-dash-network-f48533a5e6fe

EDIT 2: Anyone interested in buying one of these 8x Antminer D3's is more than welcome to buy one off of me LOL. Still in the box, PM me to set up an escrow.

Let's get this straight - I'm not here to complain about my shitty investment into the Antminer D3 which I've bought 10 of already, but I want to be frank about what the hell just happened - in ONE FOUL SWOOP, Bitmain managed to flood out one of bitcoin's main competition by showing just how weak their hashing algorithms were in terms of scalability for its mining community.

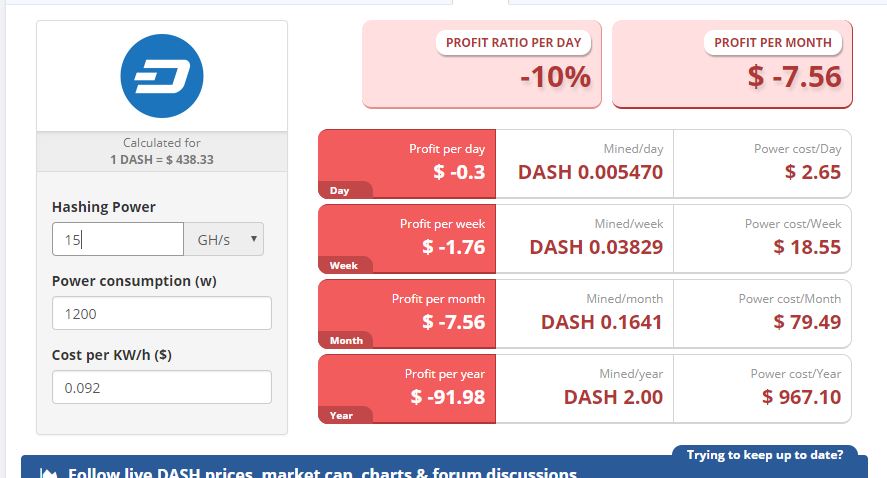

We are officially in the negative when it comes to DASH profitability with a 1500 dollar Antminer D3 with an average cost per KW/h. Now that's not the part I want anyone to focus on - but look at that DASH mined per year - 2 DASH coins. Now let's look at the hashrate, which has only very recently in its lifetime reached above 1000TH/s

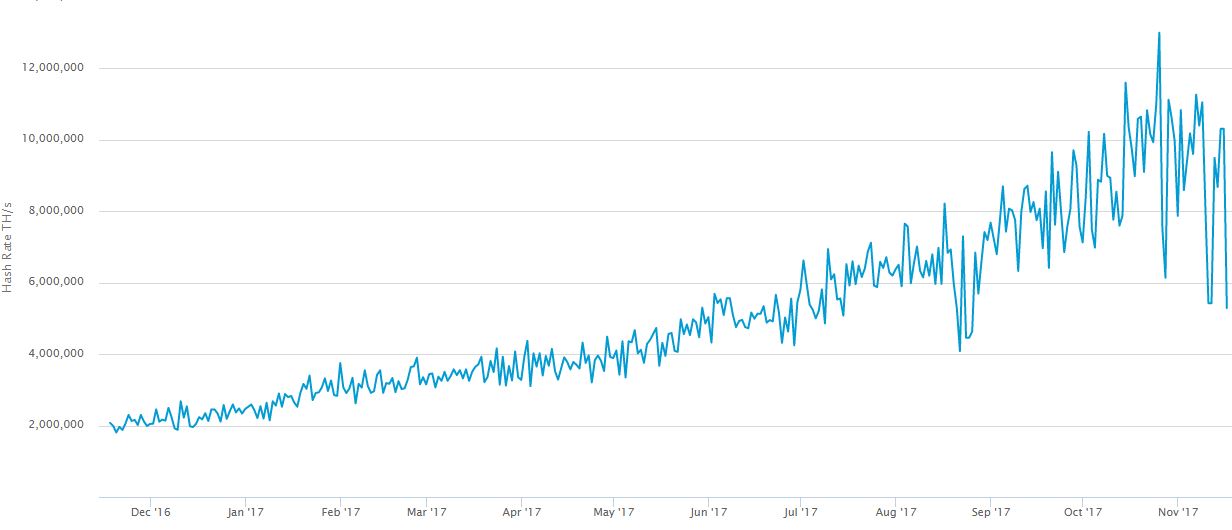

In comparison, bitcoin is at a hashrate in the 5.3 MILLION TH/s range and its profitability stays stable:

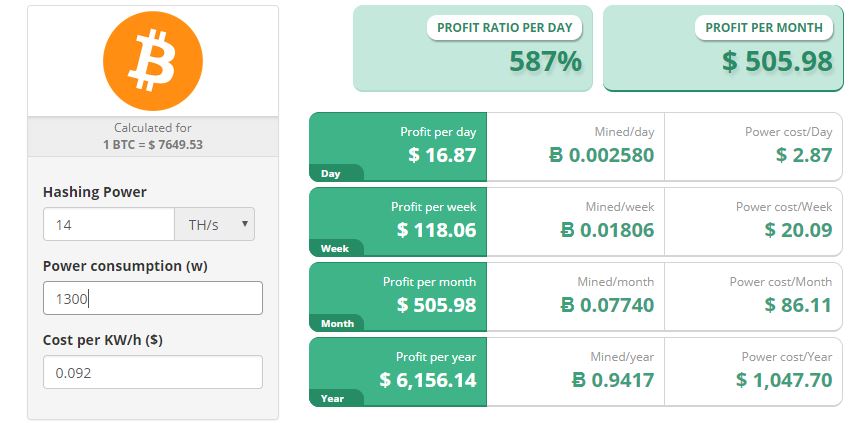

Note that their S9 basic has a hash rate 100 times the size of the D3 hashrate, yet still gives us reasonable returns:

From a mining investment point of view, it's obviously clear that bitcoin comes out superior in terms of profitability and sustainability as a business model. Most of the support and big push for bitcoin comes from its mining community - do you all honestly think your 5% governance structure is going to be enough to propel your DASH into mainstream limelight when the algorithm underlying it can't even support a few months supply of algorithm miners?

Part of the allure of bitcoin is that it created an industry under it - not just as a payment method, but also as a means of livelihood while supporting the underlying cryptocurrency structure and, in a way, propelling it into mainstream limelight due to its robust infrastructures around the world. What the hell did DASH miners get? A cryptocurrency whose profitability got flooded out by new technology WHILE using that same new technology? I'd like to remind everyone that we are only talking about 1500 TH/s. 1500... vs 5.3 million.. and its suddenly not viable to even mine it at all?

This is a serious issue in terms of scalability, and you're being delusional if you think no ones gonna take note off the lack of infrastructure DASH will be providing into the cryptocurrency sphere in comparison to bitcoin - we harp on bitcoin because of its shitty transaction speeds and high network fees, but we're literally killing DASH by not even accommodating to the mining community which supports its PoW infrastructure. In essence, DASH just hard-capped itself at the 1.5 PH/s line, while bitcoin will continue to improve itself around the world in terms of hashrate. You might have the software capable of bringing this to the masses, but without the hashrate and processing power to process those fancy 2MB/s blocks the devs have been promising, the DASH team just shot itself in the foot twice by introducing both cheaper network fees AND the promise that, somehow, 2MB/s blocks will be supported by its mining community. People are already dropping DASH mining like hotcakes everywhere - just look at ebay selling D3's for half of its price.

So, in conclusion, this is something that needs to be addressed immediately. The devs are just tip toeing around this issue by solving problems that don't even exist and building aritificial hype around the coin that shouldn't exist (why are 2MB/s blocks so important when you dont even have the tx volume or high tx fees to make it impactful?) meanwhile, their competition, bitcoin, is proving itself to be a competitor globally in terms of PoW infrastructure needed to support a global adoption to its base because, seriously, no amount of development work is going to transact thousands of trillions of dollars a day on a hash rate of 1.5 PH/s. Thanks for your time.

https://medium.com/@aquilesgomez/hi...11-algorithm-on-the-dash-network-f48533a5e6fe

https://medium.com/@aquilesgomez/hi...11-algorithm-on-the-dash-network-f48533a5e6fe

https://medium.com/@aquilesgomez/hi...11-algorithm-on-the-dash-network-f48533a5e6fe

https://medium.com/@aquilesgomez/hi...11-algorithm-on-the-dash-network-f48533a5e6fe

EDIT 2: Anyone interested in buying one of these 8x Antminer D3's is more than welcome to buy one off of me LOL. Still in the box, PM me to set up an escrow.

Let's get this straight - I'm not here to complain about my shitty investment into the Antminer D3 which I've bought 10 of already, but I want to be frank about what the hell just happened - in ONE FOUL SWOOP, Bitmain managed to flood out one of bitcoin's main competition by showing just how weak their hashing algorithms were in terms of scalability for its mining community.

We are officially in the negative when it comes to DASH profitability with a 1500 dollar Antminer D3 with an average cost per KW/h. Now that's not the part I want anyone to focus on - but look at that DASH mined per year - 2 DASH coins. Now let's look at the hashrate, which has only very recently in its lifetime reached above 1000TH/s

In comparison, bitcoin is at a hashrate in the 5.3 MILLION TH/s range and its profitability stays stable:

Note that their S9 basic has a hash rate 100 times the size of the D3 hashrate, yet still gives us reasonable returns:

From a mining investment point of view, it's obviously clear that bitcoin comes out superior in terms of profitability and sustainability as a business model. Most of the support and big push for bitcoin comes from its mining community - do you all honestly think your 5% governance structure is going to be enough to propel your DASH into mainstream limelight when the algorithm underlying it can't even support a few months supply of algorithm miners?

Part of the allure of bitcoin is that it created an industry under it - not just as a payment method, but also as a means of livelihood while supporting the underlying cryptocurrency structure and, in a way, propelling it into mainstream limelight due to its robust infrastructures around the world. What the hell did DASH miners get? A cryptocurrency whose profitability got flooded out by new technology WHILE using that same new technology? I'd like to remind everyone that we are only talking about 1500 TH/s. 1500... vs 5.3 million.. and its suddenly not viable to even mine it at all?

This is a serious issue in terms of scalability, and you're being delusional if you think no ones gonna take note off the lack of infrastructure DASH will be providing into the cryptocurrency sphere in comparison to bitcoin - we harp on bitcoin because of its shitty transaction speeds and high network fees, but we're literally killing DASH by not even accommodating to the mining community which supports its PoW infrastructure. In essence, DASH just hard-capped itself at the 1.5 PH/s line, while bitcoin will continue to improve itself around the world in terms of hashrate. You might have the software capable of bringing this to the masses, but without the hashrate and processing power to process those fancy 2MB/s blocks the devs have been promising, the DASH team just shot itself in the foot twice by introducing both cheaper network fees AND the promise that, somehow, 2MB/s blocks will be supported by its mining community. People are already dropping DASH mining like hotcakes everywhere - just look at ebay selling D3's for half of its price.

So, in conclusion, this is something that needs to be addressed immediately. The devs are just tip toeing around this issue by solving problems that don't even exist and building aritificial hype around the coin that shouldn't exist (why are 2MB/s blocks so important when you dont even have the tx volume or high tx fees to make it impactful?) meanwhile, their competition, bitcoin, is proving itself to be a competitor globally in terms of PoW infrastructure needed to support a global adoption to its base because, seriously, no amount of development work is going to transact thousands of trillions of dollars a day on a hash rate of 1.5 PH/s. Thanks for your time.

Last edited: