awesomedash

Member

Thanks for the update Darren!

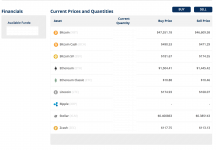

The largest self-directed IRA custodian in America, Equity Trust, is using GBI to custodial crypto investments for IRA retirement account holders. I personally use it and while it has relatively higher fees, it's been one of the best investments I've made for our Roth IRA. Of course, Dash is not available to invest. As you can imagine, this is major institutional money by Equity Trust.

One of the largest partner/investor in GBI is Dan Tapiero and he's mostly accessible through Twitter. He's featured quite a bit on Real Vision.

Here's a dashboard screenshot from my account:

View attachment 10519

I'm not sure that the DIF would be interested in something like this but thought I should bring it up anyway.

For You and @Mark Mason

A suggestion.

I have detected an interesting opportunity for Dash, to can manage the DIF.

PayPal has bought this startup:

This startup is a professional custodial solution for institutionals, and as you can see in it blog are making partnership with may Blockchain projects.

.

It would be very interesting, that Dash was included, it would allow in the future that dash to be added in Paypal easily.

I hope you investigate, and you will tell me something.

The largest self-directed IRA custodian in America, Equity Trust, is using GBI to custodial crypto investments for IRA retirement account holders. I personally use it and while it has relatively higher fees, it's been one of the best investments I've made for our Roth IRA. Of course, Dash is not available to invest. As you can imagine, this is major institutional money by Equity Trust.

One of the largest partner/investor in GBI is Dan Tapiero and he's mostly accessible through Twitter. He's featured quite a bit on Real Vision.

Here's a dashboard screenshot from my account:

View attachment 10519

I'm not sure that the DIF would be interested in something like this but thought I should bring it up anyway.

I am hungry!!! I want someone to deliver me a PIZZA!!!! But I can pay only with Dash!!! Where are those delivery boys when you need them? By the way, I can also buy a new computer with the Dash I own! My computer is 12 years old!!!! Thank you so much @Geert, for giving me 1 Dash [1] [2] five months ago! I can now buy a new computer with that money!! But where are those delivery boys, when you need them? Why do they offer their services only in Venezuela???

I WANT A DASH DELIVERY SERVICE, DIRECTLY TO MY HOME! AND I WANT IT NOW !!!!

DIF SHOULD INVEST TO DASH DELIVERY SERVICES, NOW!!!!

We have this in the US jurisdiction.

The DIF is working hard to expand into more Jurisdictions. Next up: Brazil.

@vazaki3

look at the rewards page of an Helios hotspot (that I choosed randomly among the 30000 active ones).

307,89 HNT per month reward means 307,89x17.34= 5338 USD per month!

Helium's code is OPENSOURCE!

The download link is giving me:

NO TEXT CHANNELS

You find yourself in a strange place. You don't have access to any text channels, or there are none on this server.

I just submitted my application for DIF supervisor. I included a campaign statement with the submission.

If elected I will continue to serve the DIF as I have the past year. I'm not expecting on doing anything significantly different. Over the next two years, I would hope that the DIF could bring on employees. I think it's best if the employees aren't supervisors. I would like the DIF to have $1M of liquid assets before bringing on an employee.

Please consider voting for me in the election next month.

I think we'll have a lot of good options this election and remember this is an approval style election so vote for everyone you think is qualified and helpful. If you would like to run, your application is due by Friday.