Darren

Active member

I didn't know if this was displaying properly on dash central. Here's an alternative source of the November DIF proposal information.

Dear Network,

This proposal is part of two proposals submitted for funding this cycle.

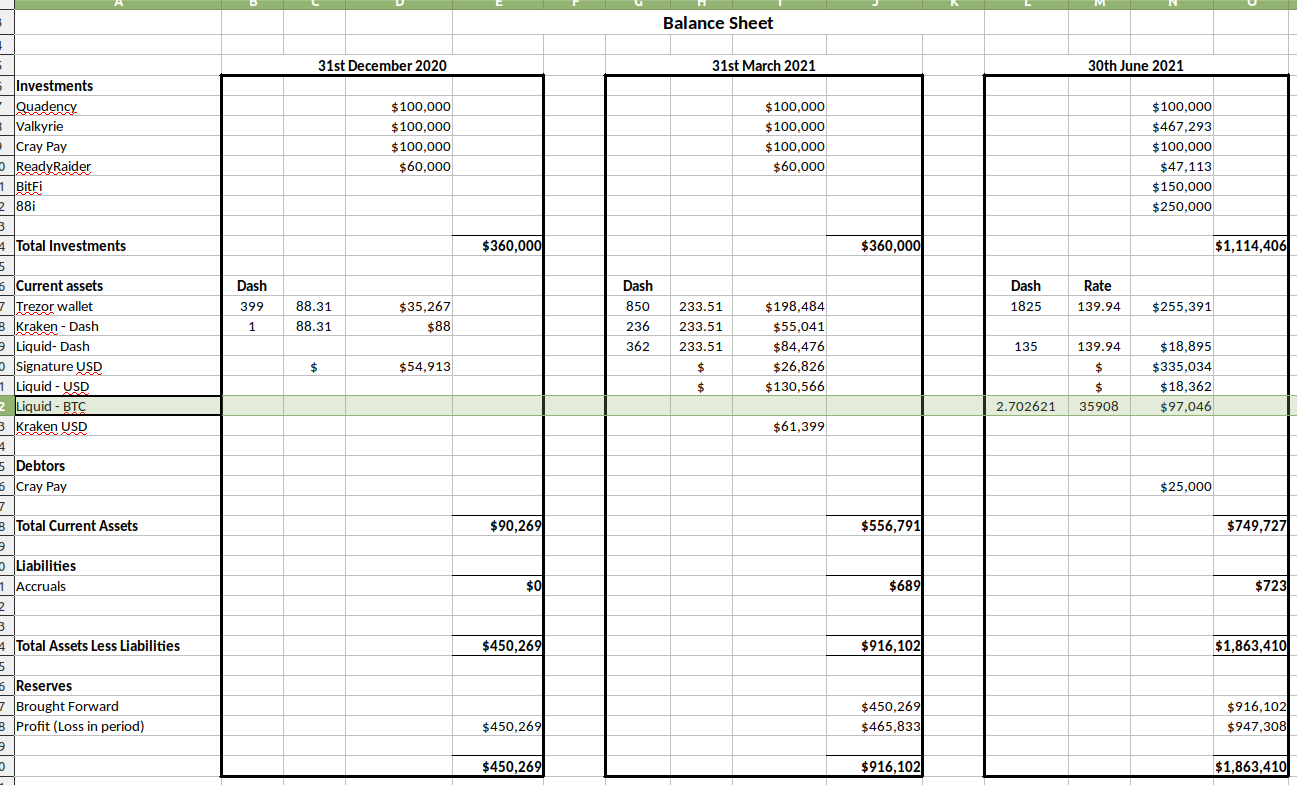

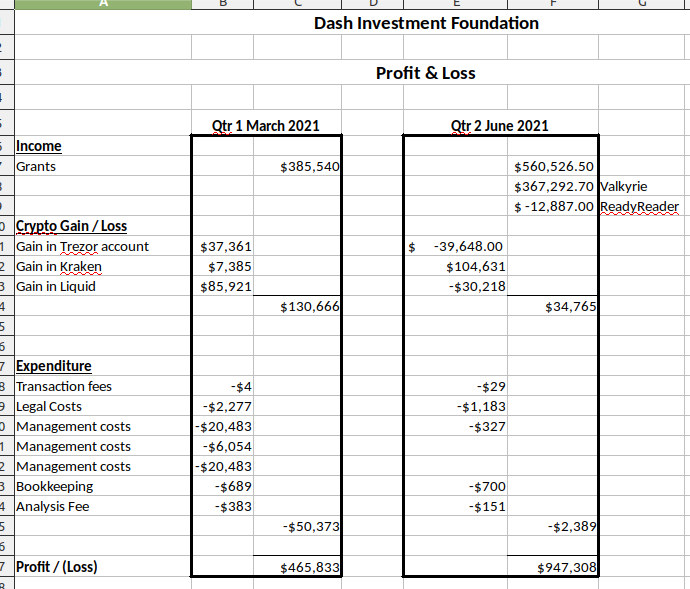

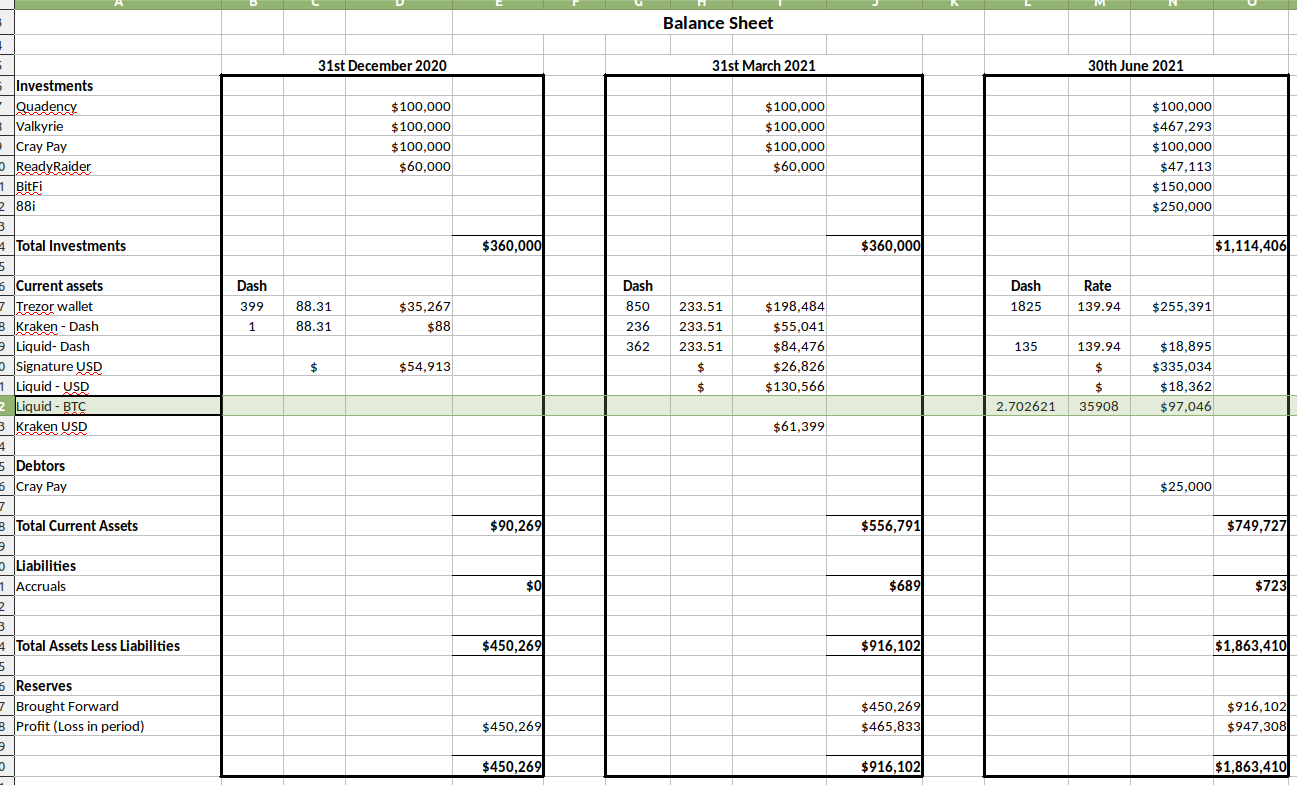

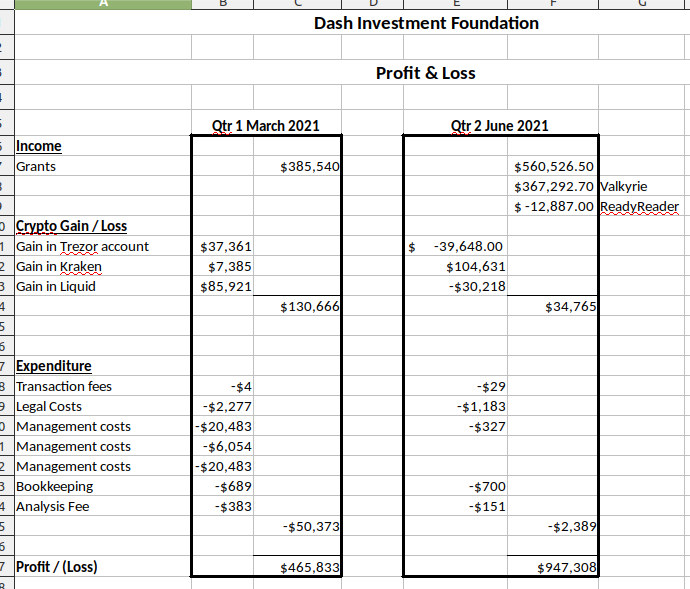

Our book keeper has prepared our Q2 balance sheet and profit and loss statement. Please find these below. After those statements you can find an update about Q3 and Q4 activities.

The sheets above are through Q2. The equity in ReadyRaider was reported at a

different valuation in Q2 because supervisors identified a reporting

error early on. The new valuation was the value of the Dash as

ReadyRaider received it. This valuation change is only for reporting and

should not reflect on ReadyRaider as a business. The closing of

Valkyrie's Series A valued the DIFs equity at a multiple. You may notice

2.7 BTC on our balance sheet. This was set aside for the purchase of

rune of THORChain. Those purchases began shortly into Q3.

In Q3 the DIF was very active with meetings, however our financial situation

was not that eventful. The DIF offered a $50k line of credit to CrayPay

secured by Dash and giftcards. The DIF felt the banks could not

accurately price the risk of accepting Dash as there is no charge back

risk with Dash. The DIF offered to provide credit at a lower interest

rate compared to the banks. CrayPay also made an interest payment (in

Dash to the DIF) in Q3. In Q3 the DIF also invested an additional $100k

in CrayPay. Two main reasons for this is we learned that CrayPay is even

stronger of a business than it was a year ago. We were also pleased

with the delivery of DashDirect.

In Q4 we have invested $450k in two companies, we are waiting on the green light from our new partners before we disclose them.

Expenses in general

From our profit and loss statement, you can see the management costs in

Q1. Two of these items are for each of our directors. The smaller item

is for the secretary which is a company qualified to house DIF

documents. This expense is annual and I expect the DIF will pay for this

service again in January.

Please consider funding this proposal. Funding we receive directly effects our strategy.

--Darren

Dear Network,

This proposal is part of two proposals submitted for funding this cycle.

- DIF ongoing funding (300 DASH Nov-Jan)

- DIF suplemental funding (400 DASH Nov only)

Our book keeper has prepared our Q2 balance sheet and profit and loss statement. Please find these below. After those statements you can find an update about Q3 and Q4 activities.

The sheets above are through Q2. The equity in ReadyRaider was reported at a

different valuation in Q2 because supervisors identified a reporting

error early on. The new valuation was the value of the Dash as

ReadyRaider received it. This valuation change is only for reporting and

should not reflect on ReadyRaider as a business. The closing of

Valkyrie's Series A valued the DIFs equity at a multiple. You may notice

2.7 BTC on our balance sheet. This was set aside for the purchase of

rune of THORChain. Those purchases began shortly into Q3.

In Q3 the DIF was very active with meetings, however our financial situation

was not that eventful. The DIF offered a $50k line of credit to CrayPay

secured by Dash and giftcards. The DIF felt the banks could not

accurately price the risk of accepting Dash as there is no charge back

risk with Dash. The DIF offered to provide credit at a lower interest

rate compared to the banks. CrayPay also made an interest payment (in

Dash to the DIF) in Q3. In Q3 the DIF also invested an additional $100k

in CrayPay. Two main reasons for this is we learned that CrayPay is even

stronger of a business than it was a year ago. We were also pleased

with the delivery of DashDirect.

In Q4 we have invested $450k in two companies, we are waiting on the green light from our new partners before we disclose them.

Expenses in general

From our profit and loss statement, you can see the management costs in

Q1. Two of these items are for each of our directors. The smaller item

is for the secretary which is a company qualified to house DIF

documents. This expense is annual and I expect the DIF will pay for this

service again in January.

Please consider funding this proposal. Funding we receive directly effects our strategy.

--Darren