glennaustin

Active member

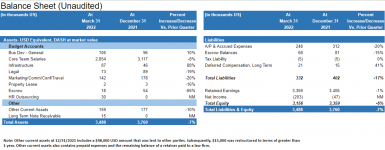

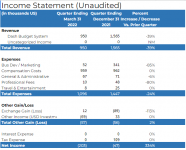

Attached are DCG Q1 results: Balance Sheet and Income Statement

Happy to answer any questions regarding the financials.

Please note that DCG Q2 2022 results will be posted by the end of July 2022.

Happy to answer any questions regarding the financials.

Please note that DCG Q2 2022 results will be posted by the end of July 2022.

Attachments

Last edited: