Icebucket

Active member

It's a shocking event that is about to happen...

It will shake the foundations of the "safest" banking system in the world, causing a major market crash around the globe...

And the wealth of millions of people will simply evaporate.

This sounds like a script from a disaster movie, but actually it is a REAL event that will happen after a specific date which I shall reveal in this essay.

Our story begins in Switzerland...

We all know that there is more to Switzerland than cheese with holes, expensive watches and a hatred of car drivers who drive fast.

Switzerland has financial institutions who promise "safety" and "secrecy"... or at least they used to.

You see, since the 1940s many affluent individuals have used the Swiss banks as a "safe haven" to store their immense wealth and fortune.

But the problem is that many European countries are seeking desperate measures to get their hands on all that wealth... legally.

This is where the UK enters our story.

The United Kingdom treasury is in need of public funds. Money has to come from taxes, from somewhere... But where?

Some years ago the UK tax authorities introduced a rather "sneaky" law in an effort to funnel as much money as they could from anyone who had money in offshore Swiss accounts.

This law starts like this:

Stage 1 - The "We took it Anyway" Phase:

Anyone who had money stashed in offshore Swiss accounts had to declare it by April 2013. If they did not declare it by that date, then they would lose 40% of that wealth as a "penalty".

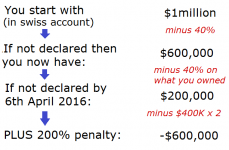

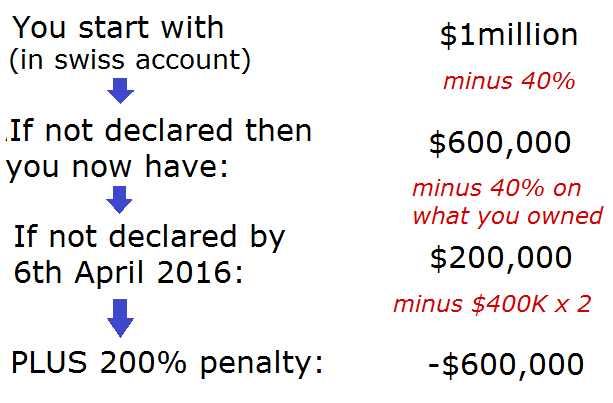

So if you started out with a million dollars in a Swiss account 5 years ago, you now have $600,000.

This means $400,000 is gone without many folks realising it.

Now comes our second stage:

Stage 2 - "Declare it or else"

You now have until 6th April 2016 to declare the money you originally owned. So in our example, you should declare the million dollars you originally owned.

So what happens when you do not declare the funds by April 2016?

Stage 3 - Market Timebomb ticking the loudest

This is when things begin to get interesting... or horrifying - depending on your perspective.

You see, if you still have not declared your wealth - say a million dollars - to the UK tax authorities by 6th April 2016, then you will suffer two disastrous consequences:

First you will lose 40% as the tax you should have paid on your money. So in our example, you will lose another $400,000.

And then comes the nasty surprise...

You will be charged a 200% penalty on top. A 200% penalty means you will pay TWO times the tax you should have paid, i.e. $800,000.

Take a look at this illustration which explains it quite simply:

This means that after 6th April 2016, many wealthy individuals who had money stashed in so-called "safe" Swiss accounts will owe more money than they originally owned.

So in our previous example, you will now OWE $600,000 to the UK tax authorities. Your entire savings have been wiped out.

You may be thinking to yourself: "But wouldn't the UK tax authorities or Swiss banks warn their clients so they avoid getting in trouble?"

Here's the beauty of it:

The Swiss banks do actually warn their clients - but not in a direct way. You see, all the Swiss banks are required to do legally is to drop a note inside their clients' safe deposit box telling them about the tax matter.

And since many clients simply do not bother to check their safe deposit box, the note will go unnoticed.

And in any case, there is no incentive for the Swiss banks to contact their clients directly since they know it may panic their clients to pull their money out of their accounts.

And as for the UK tax man... well, let's think about this.

The treasury is in need of a lot of cash. And the "timebomb" tax laws are going to bring them tons of revenue by 2016. So where is their motivation to warn anyone?

One millionaire tax expert commented: "It is disgusting what they are doing. This will decimate the Swiss banking system".

I agree.

Anyone who thinks that this is just a UK and Swiss matter is wrong. The destruction of the Swiss banking system is something very real and will affect the very core of our financial system. It will affect everyone no matter which country they live in.

(this is from a leadingtrader.com newsletter, not my own essay. Just wanted to share it with you all. Kind of scary stuff if you own a Swiss bankaccount)

It will shake the foundations of the "safest" banking system in the world, causing a major market crash around the globe...

And the wealth of millions of people will simply evaporate.

This sounds like a script from a disaster movie, but actually it is a REAL event that will happen after a specific date which I shall reveal in this essay.

Our story begins in Switzerland...

We all know that there is more to Switzerland than cheese with holes, expensive watches and a hatred of car drivers who drive fast.

Switzerland has financial institutions who promise "safety" and "secrecy"... or at least they used to.

You see, since the 1940s many affluent individuals have used the Swiss banks as a "safe haven" to store their immense wealth and fortune.

But the problem is that many European countries are seeking desperate measures to get their hands on all that wealth... legally.

This is where the UK enters our story.

The United Kingdom treasury is in need of public funds. Money has to come from taxes, from somewhere... But where?

Some years ago the UK tax authorities introduced a rather "sneaky" law in an effort to funnel as much money as they could from anyone who had money in offshore Swiss accounts.

This law starts like this:

Stage 1 - The "We took it Anyway" Phase:

Anyone who had money stashed in offshore Swiss accounts had to declare it by April 2013. If they did not declare it by that date, then they would lose 40% of that wealth as a "penalty".

So if you started out with a million dollars in a Swiss account 5 years ago, you now have $600,000.

This means $400,000 is gone without many folks realising it.

Now comes our second stage:

Stage 2 - "Declare it or else"

You now have until 6th April 2016 to declare the money you originally owned. So in our example, you should declare the million dollars you originally owned.

So what happens when you do not declare the funds by April 2016?

Stage 3 - Market Timebomb ticking the loudest

This is when things begin to get interesting... or horrifying - depending on your perspective.

You see, if you still have not declared your wealth - say a million dollars - to the UK tax authorities by 6th April 2016, then you will suffer two disastrous consequences:

First you will lose 40% as the tax you should have paid on your money. So in our example, you will lose another $400,000.

And then comes the nasty surprise...

You will be charged a 200% penalty on top. A 200% penalty means you will pay TWO times the tax you should have paid, i.e. $800,000.

Take a look at this illustration which explains it quite simply:

This means that after 6th April 2016, many wealthy individuals who had money stashed in so-called "safe" Swiss accounts will owe more money than they originally owned.

So in our previous example, you will now OWE $600,000 to the UK tax authorities. Your entire savings have been wiped out.

You may be thinking to yourself: "But wouldn't the UK tax authorities or Swiss banks warn their clients so they avoid getting in trouble?"

Here's the beauty of it:

The Swiss banks do actually warn their clients - but not in a direct way. You see, all the Swiss banks are required to do legally is to drop a note inside their clients' safe deposit box telling them about the tax matter.

And since many clients simply do not bother to check their safe deposit box, the note will go unnoticed.

And in any case, there is no incentive for the Swiss banks to contact their clients directly since they know it may panic their clients to pull their money out of their accounts.

And as for the UK tax man... well, let's think about this.

The treasury is in need of a lot of cash. And the "timebomb" tax laws are going to bring them tons of revenue by 2016. So where is their motivation to warn anyone?

One millionaire tax expert commented: "It is disgusting what they are doing. This will decimate the Swiss banking system".

I agree.

Anyone who thinks that this is just a UK and Swiss matter is wrong. The destruction of the Swiss banking system is something very real and will affect the very core of our financial system. It will affect everyone no matter which country they live in.

(this is from a leadingtrader.com newsletter, not my own essay. Just wanted to share it with you all. Kind of scary stuff if you own a Swiss bankaccount)