You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dash in Venezuela

- Thread starter sqtruong

- Start date

Pedrokey

New member

I read about the recent fast adoption of Dash in Venezuela, but I am not sure I see the big picture. How do Venezuelans buy Dash? What currency to they use to purchase Dash coins? Not with the old nor the new bolivar, right? US Dollars?

Hi sqtruong,

There are two kind of crypto-adopters: the ones who are investing in cryptos and the ones who are looking for crypto as a way of payment, of course, many times there are people who belongs to both groups.

The investors have been mostly buying miners because electricity is really cheap in Venezuela, most of the people buying miners are buying sha-256 miners. So, for them, paying in dash or bitcoin can be a good solution to avoid exchange platforms and to avoid the fees.

The other kind of crypto-adopters are mostly merchants who are open to receive crypto as a method of payment which they can later exchange into US dollars or any other currency.

There is a growing number of merchants accepting dash but we must make dash easy to access for most citizens.

Last edited:

Pedrokey

New member

I hear the Venezuela Government are not friendly toward cryptocurrency. Is there any sort of ban in that location when it comes to buy and selling of cryptocurrency?

Hi moneyrig,

The venezuelan government is encouraging the use of cryptocurrencies. They are focussed on the "petro" but legally, they allow and encourage the use of any cryptocurrency.

Of course, Dash is competing against the Petro and the government is not a fair player, in fact, they blocked the internet access to the official dash website, the people from Venezuela must use a VPN in order to enter here.

The Venezuelan economy is on life support right now. A lot of expat Venezuelans send money to relatives (remittance industry). If Dash can publicize that, it's billions of dollars.

Of course, there are substantial sanctions against Venezuela right now, and getting around those sanctions could be "go to jail" kind of breaking the law. It's a tricky business.

As a libertarian, I think many/most laws are unjust and unhelpful, so screw them. But I also have no interest in going to jail, so that's a line I'm not sure I want to cross. It's a delicate situation.

Of course, there are substantial sanctions against Venezuela right now, and getting around those sanctions could be "go to jail" kind of breaking the law. It's a tricky business.

As a libertarian, I think many/most laws are unjust and unhelpful, so screw them. But I also have no interest in going to jail, so that's a line I'm not sure I want to cross. It's a delicate situation.

Hi moneyrig,

The venezuelan government is encouraging the use of cryptocurrencies. They are focussed on the "petro" but legally, they allow and encourage the use of any cryptocurrency.

Of course, Dash is competing against the Petro and the government is not a fair player, in fact, they blocked the internet access to the official dash website, the people from Venezuela must use a VPN in order to enter here.

Hello,

I also heard about Petro. Do you think it is a good idea to invest in Petro? I know the government backs it but still, Venezuela is not a stable country so I don't know...

Pedrokey

New member

Hello,

I also heard about Petro. Do you think it is a good idea to invest in Petro? I know the government backs it but still, Venezuela is not a stable country so I don't know...

Hi nikato, it's hard for me to give any investment advise regarding the Petro because the Venezuelan government has changed it's white paper and the "backing" of it.

When the government decided to create the petro, they explained that it was going to be backing by the Venezuelan oil reserves, and its inicial price (ICO price) would be equal to 1 barrel of oil and after the ICO, its price would fluctuate depending of supply and demand on international exchanges like most currencies. But I asume they realized it was too risky to establish the Venezuelan economy and the price of our currency (the Bolivar) to such proposal. The volatility of any cryptocurrency is very high and because of the US sanctions and the low credibility of the Venezuelan government, the price of the Petro could have easily collapsed after an inicial pump... in any case, in that scenario the petro price would be very volatile as most cryptocurrencies.

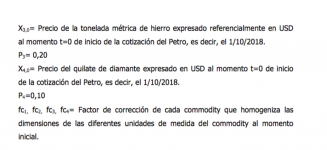

Later the government realized this and they changed everything, from the white paper to the backing, in fact, they seemed to copy partially the white paper of Dash. For example, they decided that the Petro will be mined by ¿.....? ; and that it will work under the X11 algorithm; that the petro will have masternodes managed by ¿.....? who are going to receive 85% of the mining profits. Now the Petro won't be backed just by the Venezuelan oil and if I understand well, it will be issued as a kind of stable coin, so it's price won't be affected by supply and demand of the cryptocurrency but by the price of the commodities it "represents" (this backing is completely debatable legally). I think this is a more "clever" approach to reduce volatility but maybe it makes it less attractive as an investment. They deliver this mathematical formula which I attached here, maybe someone here can help me to analyze it.

What I can tell you is that they are going to incite, motivate and even force the entire Venezuelan population to use the Petro.

Attachments

Pedrokey

New member

Very few people trust the government of Venezuela or the Petro. And don't take investment advise from random people on the internet.

That's true, that's why I'm not giving investment advise.

Hi nikato, it's hard for me to give any investment advise regarding the Petro because the Venezuelan government has changed it's white paper and the "backing" of it.

When the government decided to create the petro, they explained that it was going to be backing by the Venezuelan oil reserves, and its inicial price (ICO price) would be equal to 1 barrel of oil and after the ICO, its price would fluctuate depending of supply and demand on international exchanges like most currencies. But I asume they realized it was too risky to establish the Venezuelan economy and the price of our currency (the Bolivar) to such proposal. The volatility of any cryptocurrency is very high and because of the US sanctions and the low credibility of the Venezuelan government, the price of the Petro could have easily collapsed after an inicial pump... in any case, in that scenario the petro price would be very volatile as most cryptocurrencies.

Later the government realized this and they changed everything, from the white paper to the backing, in fact, they seemed to copy partially the white paper of Dash. For example, they decided that the Petro will be mined by ¿.....? ; and that it will work under the X11 algorithm; that the petro will have masternodes managed by ¿.....? who are going to receive 85% of the mining profits. Now the Petro won't be backed just by the Venezuelan oil and if I understand well, it will be issued as a kind of stable coin, so it's price won't be affected by supply and demand of the cryptocurrency but by the price of the commodities it "represents" (this backing is completely debatable legally). I think this is a more "clever" approach to reduce volatility but maybe it makes it less attractive as an investment. They deliver this mathematical formula which I attached here, maybe someone here can help me to analyze it.

What I can tell you is that they are going to incite, motivate and even force the entire Venezuelan population to use the Petro.

Thank you very much for the answer.

I also think that they are going to force the Venezulean population to use their cryptocurrency, however, I believe in free market and I don't think that this kind of things can be achieved with force.

cesararaujo

New member

Hello, is there any cost to publish a project?

KryptoPan

New member

Government can not block cryptocurrency transactions. Even blocking IP pages will not help. As anyone has previously noticed, you can use VPN.

A large blockage, however, may be penalisation of use cryptocurrencies. Fear of prison can stop people. Is this the case in Venezuela? I do not know.

Situation of Venezuela is very bad despite fact that this country has large oil reserves.

It shows how socialism works. In the past, it worked the same and in the future it will be similar.

It is sad that majority of society, even in developed countries of European Union, supports socialism. Unfortunately, people do not learn anything from history.

As for Petro. His credibility is the same as government Bolivar. These are the same, inept people, behind these inventions.

A large blockage, however, may be penalisation of use cryptocurrencies. Fear of prison can stop people. Is this the case in Venezuela? I do not know.

Situation of Venezuela is very bad despite fact that this country has large oil reserves.

It shows how socialism works. In the past, it worked the same and in the future it will be similar.

It is sad that majority of society, even in developed countries of European Union, supports socialism. Unfortunately, people do not learn anything from history.

As for Petro. His credibility is the same as government Bolivar. These are the same, inept people, behind these inventions.