Dash has been a legacy chain on Atomic DEX since it was created. I use their DEX daily to trade my alt basket, funded with Dash I earn and have been doing well managing that basket. Unfortunately, DEX swap volume is not great, but Dash maker liquidity is already pretty decent for small traders. The purpose of creating an Alt Index Fund for Dash is to generate more swap volume for Dash pairs on ADEX. I typically (not always) see $200 in available maker liqudity on Dash pairs there, A decent size Dash Alt Index Fund would accomplish a few things if run properly.

1) Boost Dash Atomic DEX ranking for swaps.

2) Provide extra income to Dash pair makers, encouraging more maker activity, and thus greater Dash liquidity on the DEX.

3) Since these swaps are executed on Dash blockchain, boost Dash tx numbers.

4) Potential profit (some of which would go to me as the fund manager,)

5) All coin addreses in the basket will be publicly viewable allowing the network to chart the activity and performance. (Privately shared of course)

6) Supports charity in Nigeria.

My alt basket is small, but I already use ADEX (as its called in KMD community) daily for my alt trading activity. There are a few alts that have decent liquidity on ADEX. And ADEX lets me create multiple accounts, so if the community trusted me to run something like this (because I already asked, there is no Multi Sig support) I am proposing starting with a $2000 fund weighted to a 35-45% Dash portfolio allocation against LTC, Doge, DGB, ETC, SYS, RVN, QTUM & parent coin KMD. Swaps will be executed between Dash and these active & liquid pairs.

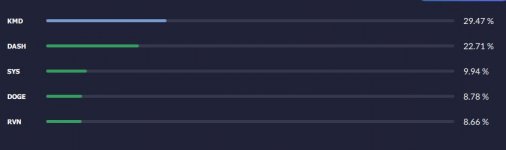

Here is a snapshot of my current allocation on my alt basket, KMD wasn't always my top allocation, it shifts around a lot depending on which coin I think is due for a large move, that is different from what I am proposing for the Dash Alt Index, profits in Dash would be taken on any significant break above 45% allocation, to static address for Burnt Hamster Publishing. I know the size of the basket is not that large, but neither is current volume on ADEX, this is more of a pilot program.

2% annual management fee paid monthly to the charity organization I support in Nigeria, the Pastor has a Multisig wallet address. $40 there will feed 8 families for 4 weeks. Nigeria is in the midst of a currency crisis. I cannot disclose the charity as there is a government clampdown on crypto, but I can get pictures of children helped with a Sign thanking the index fund. I am not in direct contact with the Pastor for security reaons, but check out my contacts YT channel and give him some love!

1) Boost Dash Atomic DEX ranking for swaps.

2) Provide extra income to Dash pair makers, encouraging more maker activity, and thus greater Dash liquidity on the DEX.

3) Since these swaps are executed on Dash blockchain, boost Dash tx numbers.

4) Potential profit (some of which would go to me as the fund manager,)

5) All coin addreses in the basket will be publicly viewable allowing the network to chart the activity and performance. (Privately shared of course)

6) Supports charity in Nigeria.

My alt basket is small, but I already use ADEX (as its called in KMD community) daily for my alt trading activity. There are a few alts that have decent liquidity on ADEX. And ADEX lets me create multiple accounts, so if the community trusted me to run something like this (because I already asked, there is no Multi Sig support) I am proposing starting with a $2000 fund weighted to a 35-45% Dash portfolio allocation against LTC, Doge, DGB, ETC, SYS, RVN, QTUM & parent coin KMD. Swaps will be executed between Dash and these active & liquid pairs.

Here is a snapshot of my current allocation on my alt basket, KMD wasn't always my top allocation, it shifts around a lot depending on which coin I think is due for a large move, that is different from what I am proposing for the Dash Alt Index, profits in Dash would be taken on any significant break above 45% allocation, to static address for Burnt Hamster Publishing. I know the size of the basket is not that large, but neither is current volume on ADEX, this is more of a pilot program.

2% annual management fee paid monthly to the charity organization I support in Nigeria, the Pastor has a Multisig wallet address. $40 there will feed 8 families for 4 weeks. Nigeria is in the midst of a currency crisis. I cannot disclose the charity as there is a government clampdown on crypto, but I can get pictures of children helped with a Sign thanking the index fund. I am not in direct contact with the Pastor for security reaons, but check out my contacts YT channel and give him some love!

Attachments

Last edited:

:max_bytes(150000):strip_icc()/Investopedia-terms-indexfund-f7a1af966bd34da5b77ca1627607e41b.png)