https://www.bloomberg.com/news/arti...missed-bitcoin-rally-go-for-dash-ether-monero

by

Olga Kharif

March 8, 2017, 6:00 PM GMT+8

“Bitcoin is expensive,” Kwon, a mother, investor, Korean interpreter and U.S. Army veteran, said in a telephone interview. “I think dash has a bigger growth rate.”

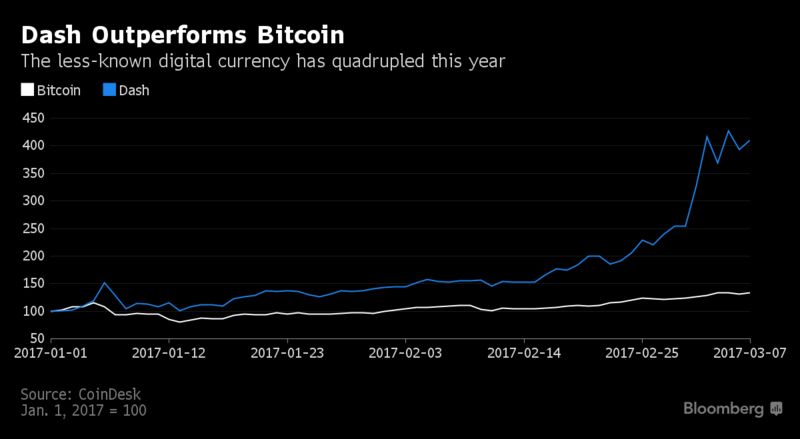

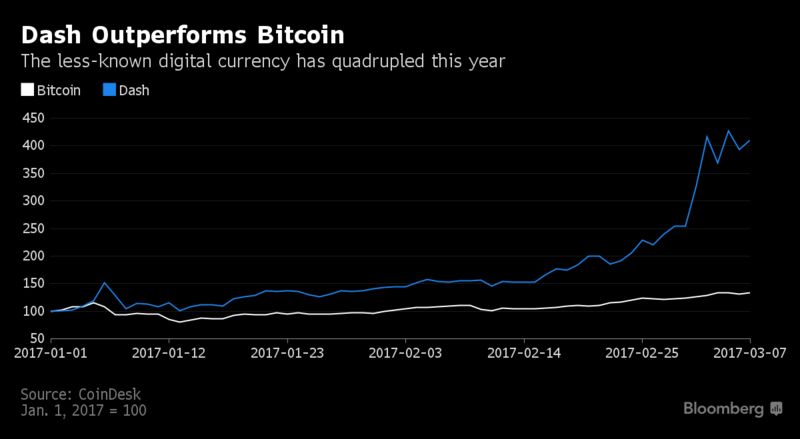

So far, it’s worked. Dash has risen to $46 from $15.20 when Kwon started, according to prices at CoinMarketCap. With a market value of $326 million, dash has become the third-largest crypto-currency, behind bitcoin and ether. Other digital currencies are on the move, too, including monero and zcash, to name some of the 700-plus out there. Investors who feel they missed out on bitcoin are seeking a different path to crypto-riches.

“They think they’ve missed most of the move, so they are starting to look at other coins that could be their ticket,” said Adam Wyatt, chief operating officer of the crypto-currency researcher BullBear Analytics.

Trading crypto-currencies is speculative. Characteristics that may give each version value include a restricted supply, the willingness of merchants to accept it as terms of trade, technical features and ultimately the faith investors put in it.

Chris Burniske, an analyst at Ark Investment Management LLC, sees signs that some investors are cashing out of bitcoin and putting funds into so-called alt coins, varieties that haven’t gone up as much. His company operates an exchange traded fund with 5 percent of its assets in blockchain -- the database technology underlying bitcoin -- and peer-to-peer computing.

Bitcoin fell 0.5 percent to 1,239.35 Tuesday in New York. It’s up 30 percent this year.

Speed Bumps

Others are trying to hedge as bitcoin approaches possible speed bumps: The first bitcoin-based exchange-traded fund is expected to be rejected or approved by U.S. regulators by March 11, and the price has risen in anticipation of new investor interest in the digital currency. A decision -- one way or the other -- could lead to more volatility.

With a rejection, “probably the entire crypto-currency market as a whole could drop,” said Alex Sunnarborg, an analyst at researcher CoinDesk, said in an interview.

Ryan Taylor, director of finance at the team that developed dash. “We are doing it by adding features customers really like. What you are seeing is recognition on the part of the users.”

Smaller markets also present major disadvantages: The currencies tend to be less liquid, and more volatile. Large holdings of dash, for example, are concentrated in several thousand hands, Burniske said.

Not that that’s deterring investors like Kwon, who are partial to crypto-currencies because they reduce dependence on money regulated by central banks.

“We need some alternative currency other than fiat currency, and bitcoin is too slow and expensive,” Kwon said.

by

Olga Kharif

March 8, 2017, 6:00 PM GMT+8

- Lesser crypto-currencies rise as bitcoin soars toward $1,300

- Privacy features, faster networks give alt coins their value

“Bitcoin is expensive,” Kwon, a mother, investor, Korean interpreter and U.S. Army veteran, said in a telephone interview. “I think dash has a bigger growth rate.”

So far, it’s worked. Dash has risen to $46 from $15.20 when Kwon started, according to prices at CoinMarketCap. With a market value of $326 million, dash has become the third-largest crypto-currency, behind bitcoin and ether. Other digital currencies are on the move, too, including monero and zcash, to name some of the 700-plus out there. Investors who feel they missed out on bitcoin are seeking a different path to crypto-riches.

“They think they’ve missed most of the move, so they are starting to look at other coins that could be their ticket,” said Adam Wyatt, chief operating officer of the crypto-currency researcher BullBear Analytics.

Trading crypto-currencies is speculative. Characteristics that may give each version value include a restricted supply, the willingness of merchants to accept it as terms of trade, technical features and ultimately the faith investors put in it.

Chris Burniske, an analyst at Ark Investment Management LLC, sees signs that some investors are cashing out of bitcoin and putting funds into so-called alt coins, varieties that haven’t gone up as much. His company operates an exchange traded fund with 5 percent of its assets in blockchain -- the database technology underlying bitcoin -- and peer-to-peer computing.

Bitcoin fell 0.5 percent to 1,239.35 Tuesday in New York. It’s up 30 percent this year.

Speed Bumps

Others are trying to hedge as bitcoin approaches possible speed bumps: The first bitcoin-based exchange-traded fund is expected to be rejected or approved by U.S. regulators by March 11, and the price has risen in anticipation of new investor interest in the digital currency. A decision -- one way or the other -- could lead to more volatility.

With a rejection, “probably the entire crypto-currency market as a whole could drop,” said Alex Sunnarborg, an analyst at researcher CoinDesk, said in an interview.

Ryan Taylor, director of finance at the team that developed dash. “We are doing it by adding features customers really like. What you are seeing is recognition on the part of the users.”

Smaller markets also present major disadvantages: The currencies tend to be less liquid, and more volatile. Large holdings of dash, for example, are concentrated in several thousand hands, Burniske said.

Not that that’s deterring investors like Kwon, who are partial to crypto-currencies because they reduce dependence on money regulated by central banks.

“We need some alternative currency other than fiat currency, and bitcoin is too slow and expensive,” Kwon said.