Sub-Ether

Well-known member

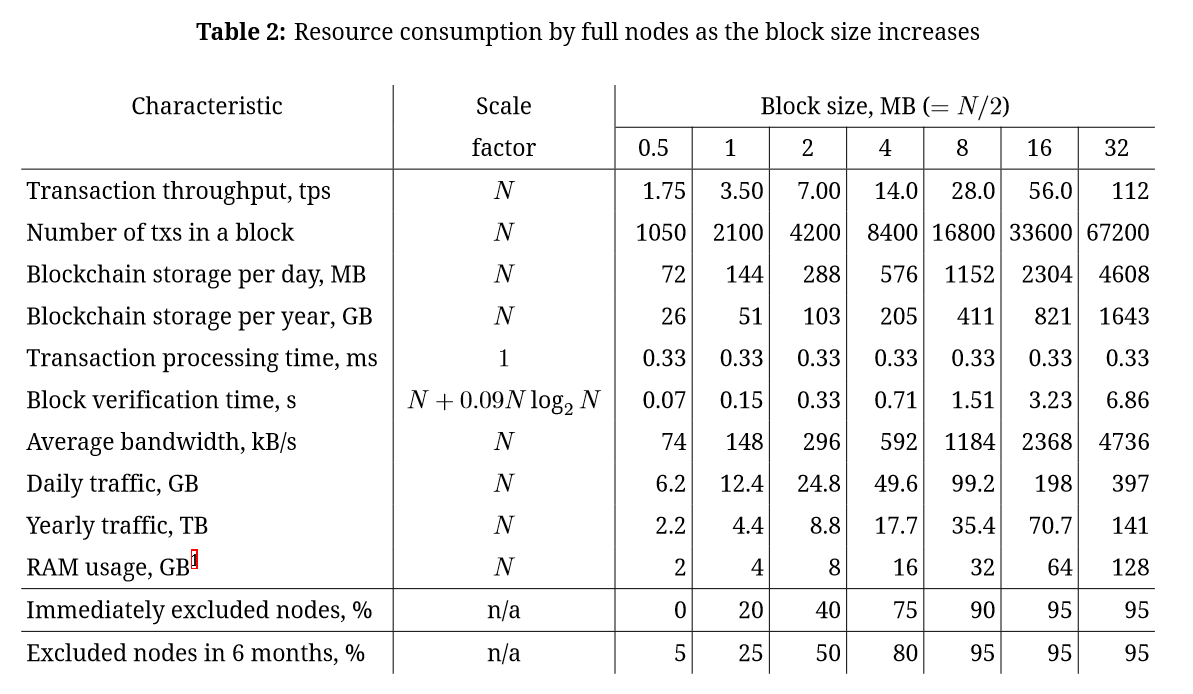

This is an in depth look at what larger blocks mean for bitcoin (and us), try starting with table 2 on page 4.

http://bitfury.com/content/5-white-...ase/bitfury-report-on-block-size-increase.pdf

Table 2

So if 8 megabyte blocks were instigated, for a full block, there is required 1.1 GB of hard drive space per day, and 411 GB per year!

I would have thought accessing such a large amount of data would require specialist upgraded hardware and a rather meaty internet connection.

Ironically even with such a setup, the 8 meg version only gives 28 transaction throughput per second, which is thousands of times less than what visa turnover (and instantX has already reached over 100 tps, which is the equivalent of the rather large 32 MB blocks)

Btw, the assumption that the transaction throughput(tps) scales linearly with blocksize is somewhat incorrect for future tx if the network has spikes of high activity (such as the recent stress tests, producing a 5 hr delay), because if the transaction cache increases then:-

So with a 8 MB block gives N=8, and the memory cache, S = 2000, t = average time to lookup a single transaction

block verification time = t * log2 ( N * S )

if the transaction cache increases due to a stressed network, the block verification time will increase, a survey suggested over half of the bitcoin nodes had insufficient RAM in order to process the unspent transactions cache , hence the delays will be accentuated.

http://bitfury.com/content/5-white-...ase/bitfury-report-on-block-size-increase.pdf

Table 2

So if 8 megabyte blocks were instigated, for a full block, there is required 1.1 GB of hard drive space per day, and 411 GB per year!

I would have thought accessing such a large amount of data would require specialist upgraded hardware and a rather meaty internet connection.

Ironically even with such a setup, the 8 meg version only gives 28 transaction throughput per second, which is thousands of times less than what visa turnover (and instantX has already reached over 100 tps, which is the equivalent of the rather large 32 MB blocks)

Btw, the assumption that the transaction throughput(tps) scales linearly with blocksize is somewhat incorrect for future tx if the network has spikes of high activity (such as the recent stress tests, producing a 5 hr delay), because if the transaction cache increases then:-

So with a 8 MB block gives N=8, and the memory cache, S = 2000, t = average time to lookup a single transaction

block verification time = t * log2 ( N * S )

if the transaction cache increases due to a stressed network, the block verification time will increase, a survey suggested over half of the bitcoin nodes had insufficient RAM in order to process the unspent transactions cache , hence the delays will be accentuated.